Diversifying brokers into wholesale property: Finsure introduces Infynity automated referrals to Wealth Street

16 April 2024

In a move to revolutionise mortgage broker productivity, Wealth Street and Finsure team up to offer brokers an unparalleled advantage.

Effective 19th April, 2024, Finsure brokers gain the ability to automate referrals of pre-approved investment clients directly to Wealth Street’s Investment Specialists through Infynity. This signals a commitment to revolutionising investment loan pre-approval processing by converting them into wholesale property investments and securing your income as a broker.

John Zada, CEO of Wealth Street, sums it up perfectly: “Integrating with Finsure, Australia’s fastest-growing loan aggregator, makes perfect sense. They’re on a mission to improve the market for all, and this is one way we support this mission.”

This update arrives amidst shifting market dynamics that point to investment opportunities:

- Anticipated interest rate drops by the end of 2024.

- Record-high population growth.

- Building undersupply and ~1% vacancy rates.

- Predicted 20% national property value increase in the next 18 months.

Property remains a cornerstone of wealth creation. Residential real estate is booming, with values reaching $10.4 trillion and credit demand hitting a record high of $105.1 billion.

Despite market challenges, the increasing demand for rental properties signifies a golden opportunity for investors – an opportunity you can empower them to seize.

Brokers combat inactivity by diversifying into wholesale property investment

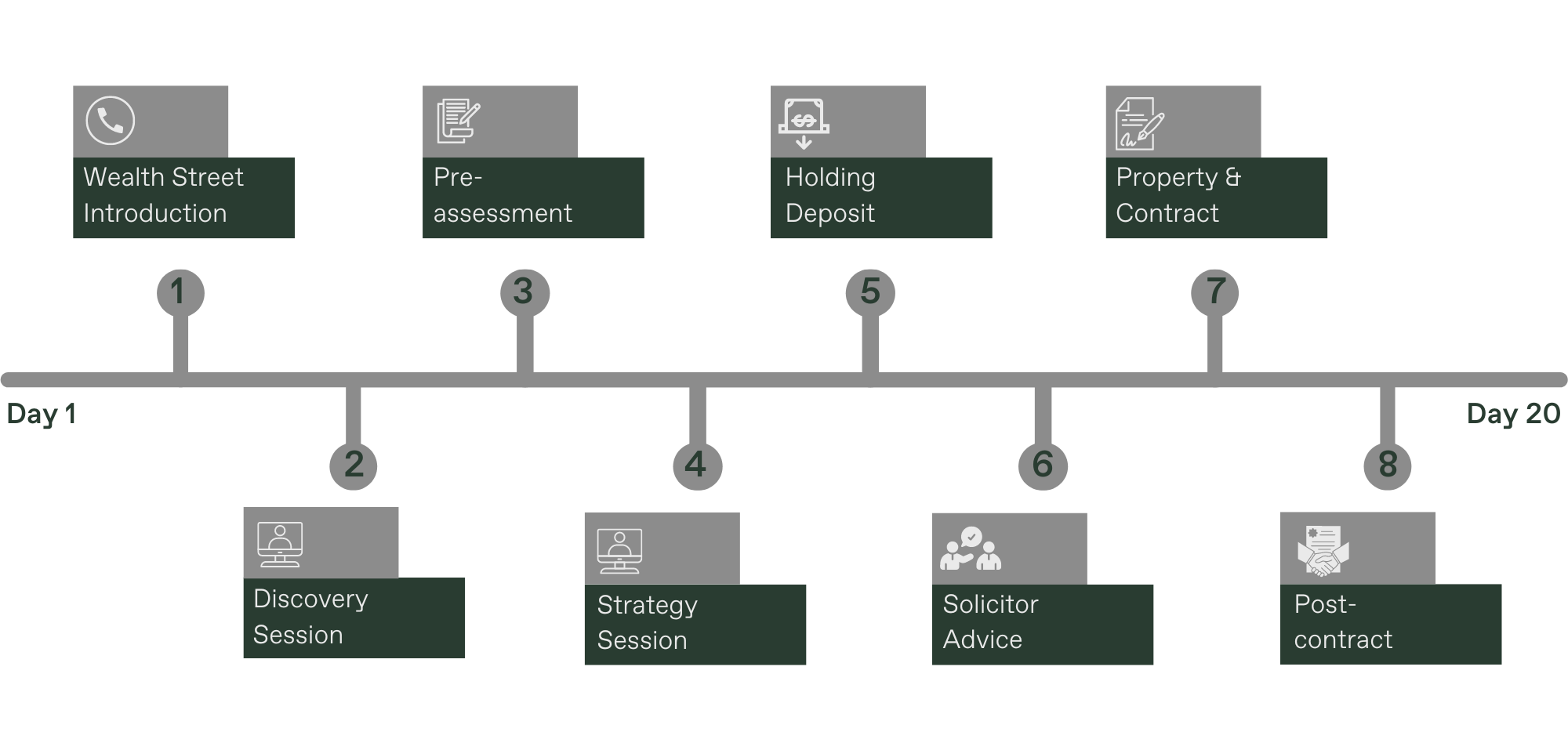

Wealth Street can convert 90-day investment pre-approvals into successful property settlements in as little as 20 days, with properties complete in 6-9 months. This translates to significant advantages:

- Diversify into off-market opportunities: With 70% of new loans written by mortgage brokers, this integration allows you to leverage exclusive properties and fortify your pipeline against market fluctuations, clawbacks and lead leakage.

- Solve client problems: Many clients feel priced out of the owner-occupier market. Wealth Street empowers you to help them address tax burdens, debts and inadequate superannuation through strategic investment property solutions.

- Enhance earning potential: By offering off-market investment opportunities backed by multinationals like Toyota, Panasonic and Alceon, you can increase your earning potential while meeting client needs and boosting satisfaction.

Empowering mortgage brokers beyond pre-approvals

This integration empowers you to go beyond pre-approvals. Finsure data from 2023 reveals a concerning trend: almost 50% of pre-approved investment loans lapsed, resulting in up to $1 billion in lost revenue (per month) for mortgage brokers and missed capital gains for clients. Wealth Street bridges this gap.

Our meticulous wholesale property selection process ensures client satisfaction and successful conversions. We provide expert guidance, empowering you to navigate the complex and often-elusive off-market investment landscape. Without securing investment properties beyond pre-approvals, mortgage brokers risk losing clients to competitors and stunting book growth.

Many investors lack crucial knowledge about investment-grade properties, equity leverage, tax minimisation strategies, or superannuation optimisation through property. Wealth Street equips you to be their trusted guide.

Working smarter, not harder, with Wealth Street

Think of Wealth Street as your plug-and-play investment property division. You retain control over loan writing and earn up to 1.5% additional referral fees compared to traditional bank commissions.

We prioritise your client’s financial journey by collaborating with you and providing access to valuable market data and educational resources. This empowers you to identify profitable opportunities and become a true property investment specialist.

Here’s what a $700K property referral through Infynity means for you:

$11.5K+ in total commissions: $7K W.ST + $4.5K bank*

*Refer more to earn more. Your commission starts at 1% and scales up to 1.5% for repeat referrals (10+).

As Damien Thompson, Finsure’s Head of Diversified and Asset Finance, emphasises, “Wholesale investment properties offer brokers a strategic advantage in a competitive market.”

Refer now, become accredited later

Don’t wait to get started. You can refer clients to Wealth Street without accreditation while we help them navigate the wholesale property investment process.

By capitalising on every pre-approval and simplifying the property search, we ensure clients achieve their investment goals while enhancing your productivity and profitability.

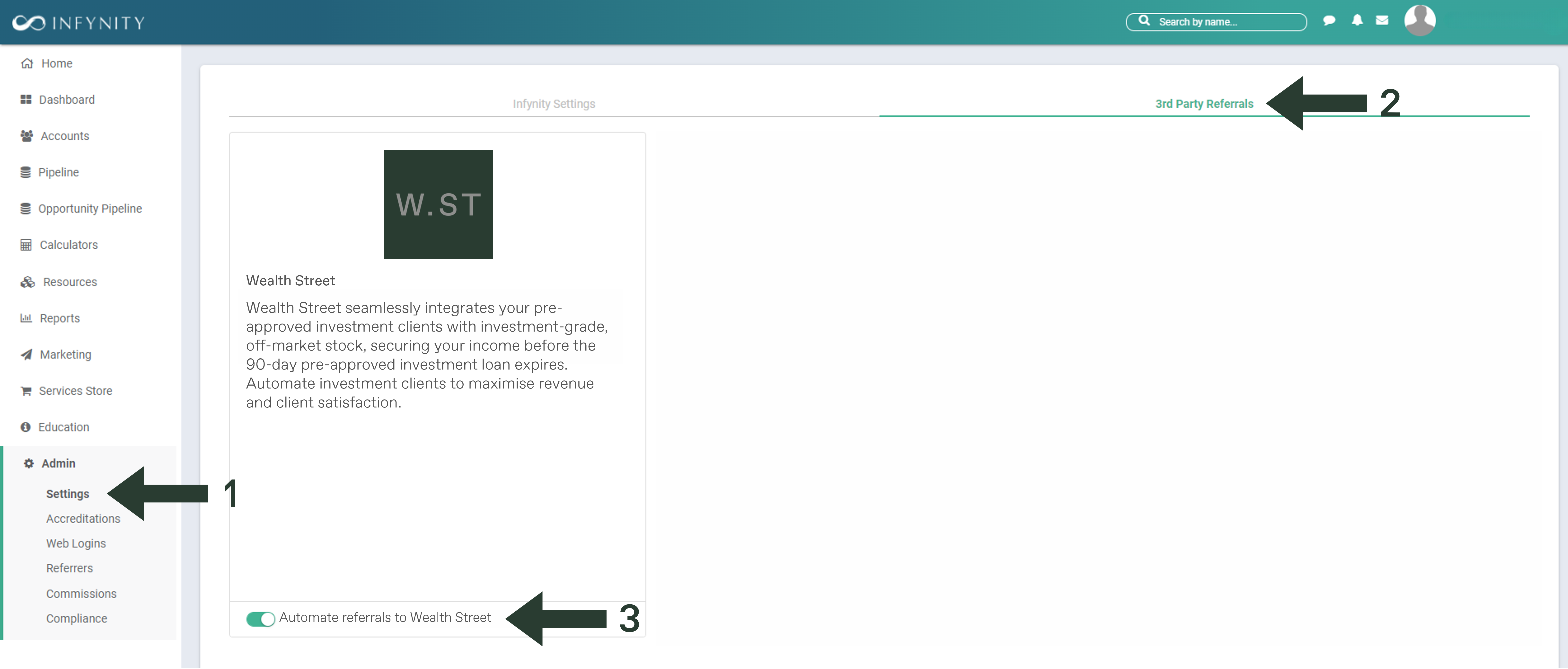

Automate referrals within Infynity in 3 easy steps:

- Open Admin Menu > Settings.

- Locate “3rd Party Referrals”.

- Click to activate – automate instantly.

Upon receiving a referral, we’ll contact you within 48 business hours to confirm your client’s pre-approval status.

Throughout the entire investment process, we take a collaborative approach with our mortgage broker partners. From the initial touchpoint to settlement, you and your clients are kept informed via phone and email correspondence.

Want to find out more about the Wealth Street Partnership Program?

"Wholesale investment properties offer brokers a strategic advantage in a competitive market."

Damien Thompson

Head of Diversified & Asset Finance at FinsureGet Started

Every success story starts with a leap of faith. Start a conversation with us.