Invest with clarity and confidence

Navigating the world of property investment can feel like deciphering a complex code. Don't let the unknown hold you back from achieving your financial goals.

A clear path to securing your future

Define objectives and goals

Connect with your Wealth Street Investment Specialist who will assess your existing financial situation and help define your objectives and goals.

Receive your personalised investment plan

We formulate a personalised investment plan that relies on data-driven strategies rather than emotions or floor plans. Our goal is to align your financial aspirations with the right investment opportunities.

Gain access to off-market investment-grade properties

Properties are meticulously selected through rigorous processes. We conduct independent research, evaluating economic factors like population growth, infrastructure spending, and employment prospects.

A smooth and rewarding journey

Navigate the investment landscape with confidence. We collaborate closely with your mortgage broker, builders, developers, solicitors, and conveyancers to minimise risk. Transform property investment into an enlightening and rewarding journey.

Benefit from additional passive income and capital growth

Navigate the investment landscape with confidence and independence. We accompany clients on their investment journey, providing continual support, advice and education to pay down debt, minimise tax and grow your wealth.

Empowered financial freedom

Enjoy access to continued support, in-depth advice and education tailored to your changing lifestyle goals and objectives. We’re here to help empower your financial literacy to retire comfortably and live life well.

A clear path to securing your future

Define objectives and goals

Connect with your Wealth Street Investment Specialist who will assess your existing financial situation and help define your objectives and goals.

Receive your personalised investment plan

We formulate a personalised investment plan that relies on data-driven strategies rather than emotions or floor plans. Our goal is to align your financial aspirations with the right investment opportunities.

Gain access to off-market investment-grade properties

Properties are meticulously selected through rigorous processes. We conduct independent research, evaluating economic factors like population growth, infrastructure spending, and employment prospects.

A smooth and rewarding journey

Navigate the investment landscape with confidence. We collaborate closely with your mortgage broker, builders, developers, solicitors, and conveyancers to minimise risk. Transform property investment into an enlightening and rewarding journey.

Benefit from additional passive income and capital growth

Navigate the investment landscape with confidence and independence. We accompany clients on their investment journey, providing continual support, advice and education to pay down debt, minimise tax and grow your wealth.

Empowered financial freedom

Enjoy access to continued support, in-depth advice and education tailored to your changing lifestyle goals and objectives. We’re here to help empower your financial literacy to retire comfortably and live life well.

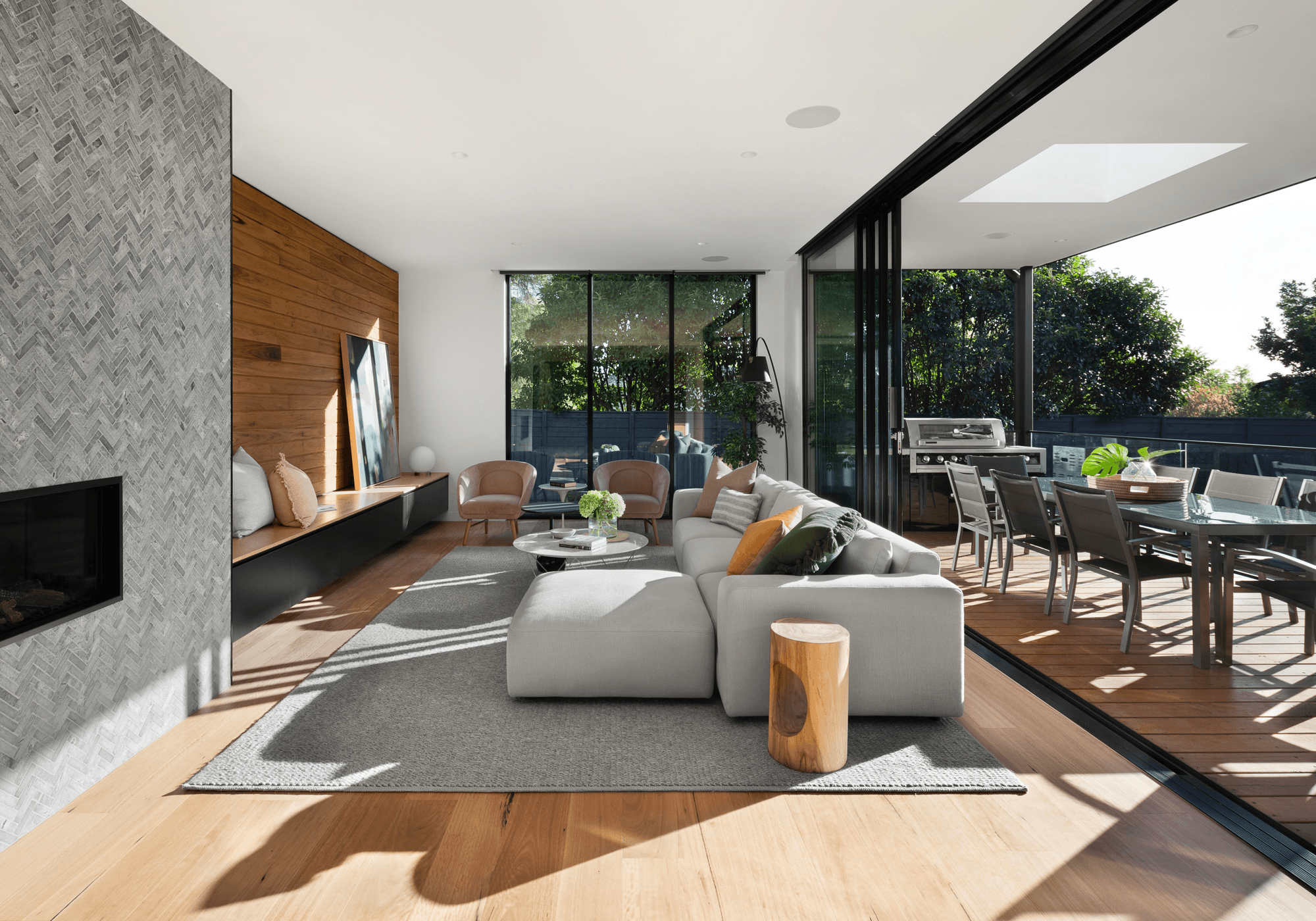

Invest with peace of mind

Make informed investment decisions with expert guidance, in-depth research, education and the right investment strategy that aligns with your needs.

A seamless wealth building experience

Our team of experts, including your trusted mortgage broker and exclusive developers guide you through every step, ensuring a smooth and informed investment journey.

Generate reliable cash flow

Invest in properties that generate regular cash flow, reduce debt and ensure financial freedom. Discover how property investments can provide a reliable income stream for lasting financial stability.

Minimise tax liability

Minimise your tax burden and maximise savings by leveraging optimised deductions on mortgage interest, maintenance costs, and property taxes. Learn how strategic tax planning can enhance your financial benefits.

Maximised investment returns

Unlock the full potential of your investments with a personalised investment strategy. Benefit from exclusive off-market opportunities and strategic partnerships with brokers and developers to maximise your investment returns.

Build lasting wealth

Achieve lasting wealth and financial security through appreciating assets. With ongoing support and guidance, confidently pursue your goals and establish a solid foundation for long-term prosperity for yourself and your loved ones.

NSW

"I have been a client of Wealth Street for about 10 years. I have found the advice and help in purchasing property, refinancing and investment invaluable and outstanding. I would not have the financial security I have today without this amazing company. I have recommended them to my friends and family who have also been impressed by their outstanding advice and professionalism.”

Review Wealth Street↑ $475,000

Growth since purchase

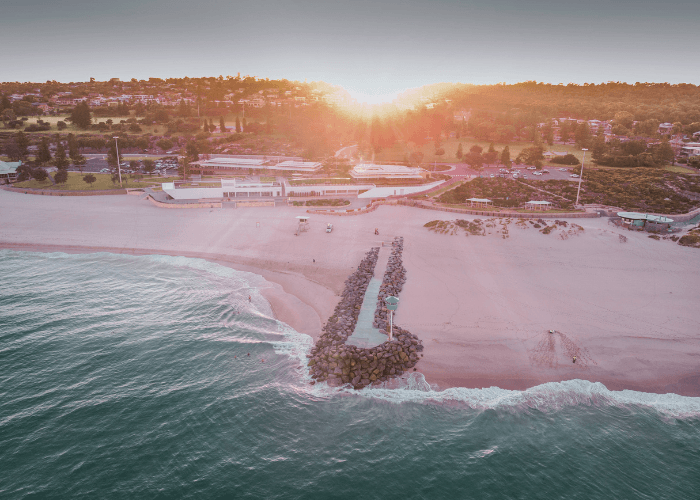

Harsha and Ashwini

Sydney, NSW

Harsha and Ashwini gained $475,000 growth in 3 years on their first property, and $96,000 growth on the second, transforming property investment into a rewarding journey.

VIEW CASE STUDY

Wealth Street Journal: Week 9, 2025

Wealth Street Journal: Week 7, 2025

Wealth Street Journal: Week 6, 2025

Wealth Street Journal: Week 5, 2025

Wealth Street Journal: Week 4, 2025

Wealth Street Journal: Week 3, 2025

Wealth Street Journal: Week 2, 2025

Wealth Street Journal: Week 52, 2024

Wealth Street Journal: Week 51, 2024

Wealth Street Journal: Week 50, 2024

Wealth Street Journal: Week 49, 2024

3 Top Tax Tips to Help You Navigate Tax Time

Wealth Street Journal: Week 26, 2024

Wealth Street Journal: Week 23, 2024

Wealth Street Journal: Week 22, 2024

Wealth Street Journal: Week 21, 2024

Wealth Street Journal: Week 20, 2024

Wealth Street Journal: Week 19, 2024

Wealth Street Journal: Week 18, 2024

Wealth Street Journal: Week 17, 2024

Diversifying brokers into wholesale property: Finsure introduces Infynity automated referrals to Wealth Street

Wealth Street Journal: Week 16, 2024

Wealth Street Journal: Week 15, 2024

Wealth Street Journal: Week 14, 2024

Wealth Street Journal: Week 13, 2024

Inflation Eases: Property Market Opportunity For Investors?

The Australian Housing Market: 2023 in charts with CoreLogic

Steering brokers towards success: A message from our CEO

Peek into the future: 5 factors set to transform the property market in 2024

Wealth Street and Finsure light up Diwali with a celebration to remember

How to use equity to invest in property

Australian housing market defies challenges: CoreLogic November housing chart update

National Construction Code 2022 (NCC) update: A glimpse into Queensland’s leading role in home accessibility and energy efficiency

Australian real estate surpasses $10 trillion: CoreLogic October housing chart update

From the rugby pitch to property: George Burgess joins Wealth Street

Australian real estate soars to $10 trillion: CoreLogic September housing chart update

An Australian-first: Wealth Street integrates into Finsure’s CRM

RBA interest rates on hold; have interest rates peaked?

Empowering brokers for business excellence: Inside our EOS annual planning session

Why invest in residential property now?

Houses vs units; which is the better investment property in Australia?

Switching fields: Luke Burgess goes from NRL Rabbitohs to Wealth Street’s financial arena

Welcome to the new Wealth Street

A CEO’s perspective: Navigating our core values at Wealth Street

Australian property values continue to climb: CoreLogic August housing chart update

How rising interest rates can benefit property investors in Australia

Australian property prices defying interest rate rises: CoreLogic July housing chart update

The power of time in the property market

Unlocking tax benefits for your property investor clients

Get Started

Every success story starts with a leap of faith. Start a conversation with us.