Build your wealth from anywhere

Living abroad offers incredible experiences but managing your finances and navigating property investments across borders can be complex. Our experienced investment team help you make empowered financial decisions, grow your wealth and achieve your dream lifestyle wherever life takes you.

How we help

Focus on what matters

We handle everything so you can enjoy a seamless investment experience and focus on what matters most.

A customised roadmap

Together, we craft a personalised wealth strategy tailored to your unique goals, income, tax situation and residency.

Expert guidance

Navigate successful investing from abroad with our local market knowledge, industry connections and expertise. We guide you through investment, residency and tax complexities.

How we help

Focus on what matters

We handle everything so you can enjoy a seamless investment experience and focus on what matters most.

A customised roadmap

Together, we craft a personalised wealth strategy tailored to your unique goals, income, tax situation and residency.

Expert guidance

Navigate successful investing from abroad with our local market knowledge, industry connections and expertise. We guide you through investment, residency and tax complexities.

Network of experts

We work closely with a strong network of legal, finance and accounting contacts across Australia to provide you a comprehensive support system for your investment journey.

Local market knowledge

We leverage local real estate market knowledge and in-depth research and industry expertise for superior returns.

Property Investment

Off-market Opportunities

Access exclusive, off-market, investment grade opportunities through our strong network with top-tier developers and builders.

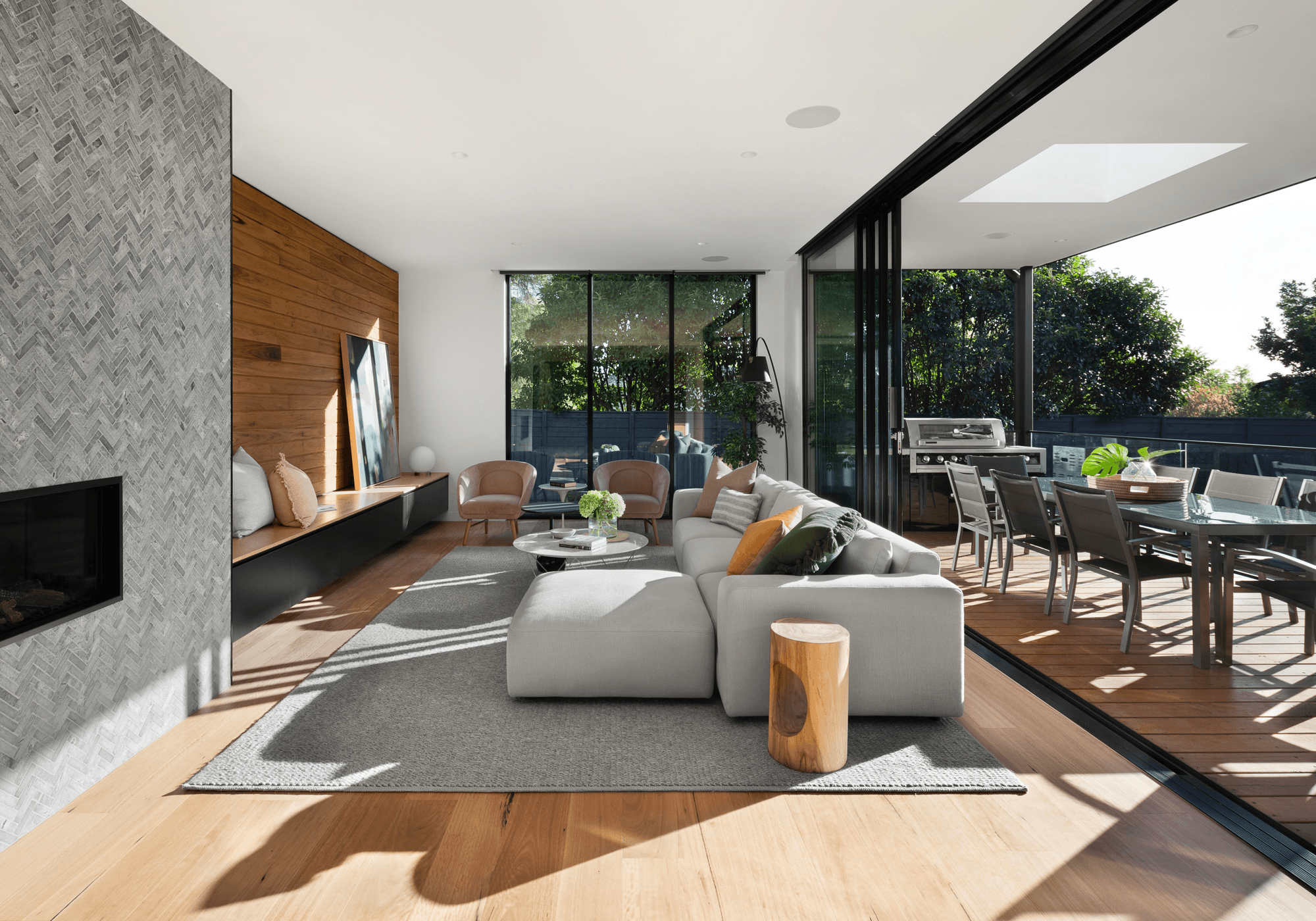

Build lasting wealth

With ongoing support and guidance, confidently pursue your goals and establish a solid foundation for long-term prosperity for yourself and your loved ones.

↑ $475,000

Growth since purchase

Harsha and Ashwini

Sydney, NSW

Harsha and Ashwini gained $475,000 growth in 3 years on their first property, and $96,000 growth on the second, transforming property investment into a rewarding journey.

VIEW CASE STUDY

Wealth Street Journal: Week 9, 2025

Wealth Street Journal: Week 7, 2025

Wealth Street Journal: Week 6, 2025

Wealth Street Journal: Week 5, 2025

Wealth Street Journal: Week 4, 2025

Wealth Street Journal: Week 3, 2025

Wealth Street Journal: Week 2, 2025

Wealth Street Journal: Week 52, 2024

Wealth Street Journal: Week 51, 2024

Wealth Street Journal: Week 50, 2024

Wealth Street Journal: Week 49, 2024

3 Top Tax Tips to Help You Navigate Tax Time

Wealth Street Journal: Week 26, 2024

Wealth Street Journal: Week 23, 2024

Wealth Street Journal: Week 22, 2024

Wealth Street Journal: Week 21, 2024

Wealth Street Journal: Week 20, 2024

Wealth Street Journal: Week 19, 2024

Wealth Street Journal: Week 18, 2024

Wealth Street Journal: Week 17, 2024

Diversifying brokers into wholesale property: Finsure introduces Infynity automated referrals to Wealth Street

Wealth Street Journal: Week 16, 2024

Wealth Street Journal: Week 15, 2024

Wealth Street Journal: Week 14, 2024

Wealth Street Journal: Week 13, 2024

Inflation Eases: Property Market Opportunity For Investors?

The Australian Housing Market: 2023 in charts with CoreLogic

Steering brokers towards success: A message from our CEO

Peek into the future: 5 factors set to transform the property market in 2024

Wealth Street and Finsure light up Diwali with a celebration to remember

How to use equity to invest in property

Australian housing market defies challenges: CoreLogic November housing chart update

National Construction Code 2022 (NCC) update: A glimpse into Queensland’s leading role in home accessibility and energy efficiency

Australian real estate surpasses $10 trillion: CoreLogic October housing chart update

From the rugby pitch to property: George Burgess joins Wealth Street

Australian real estate soars to $10 trillion: CoreLogic September housing chart update

An Australian-first: Wealth Street integrates into Finsure’s CRM

RBA interest rates on hold; have interest rates peaked?

Empowering brokers for business excellence: Inside our EOS annual planning session

Why invest in residential property now?

Houses vs units; which is the better investment property in Australia?

Switching fields: Luke Burgess goes from NRL Rabbitohs to Wealth Street’s financial arena

Welcome to the new Wealth Street

A CEO’s perspective: Navigating our core values at Wealth Street

Australian property values continue to climb: CoreLogic August housing chart update

How rising interest rates can benefit property investors in Australia

Australian property prices defying interest rate rises: CoreLogic July housing chart update

The power of time in the property market

Unlocking tax benefits for your property investor clients

Get Started

Every success story starts with a leap of faith. Start a conversation with us.