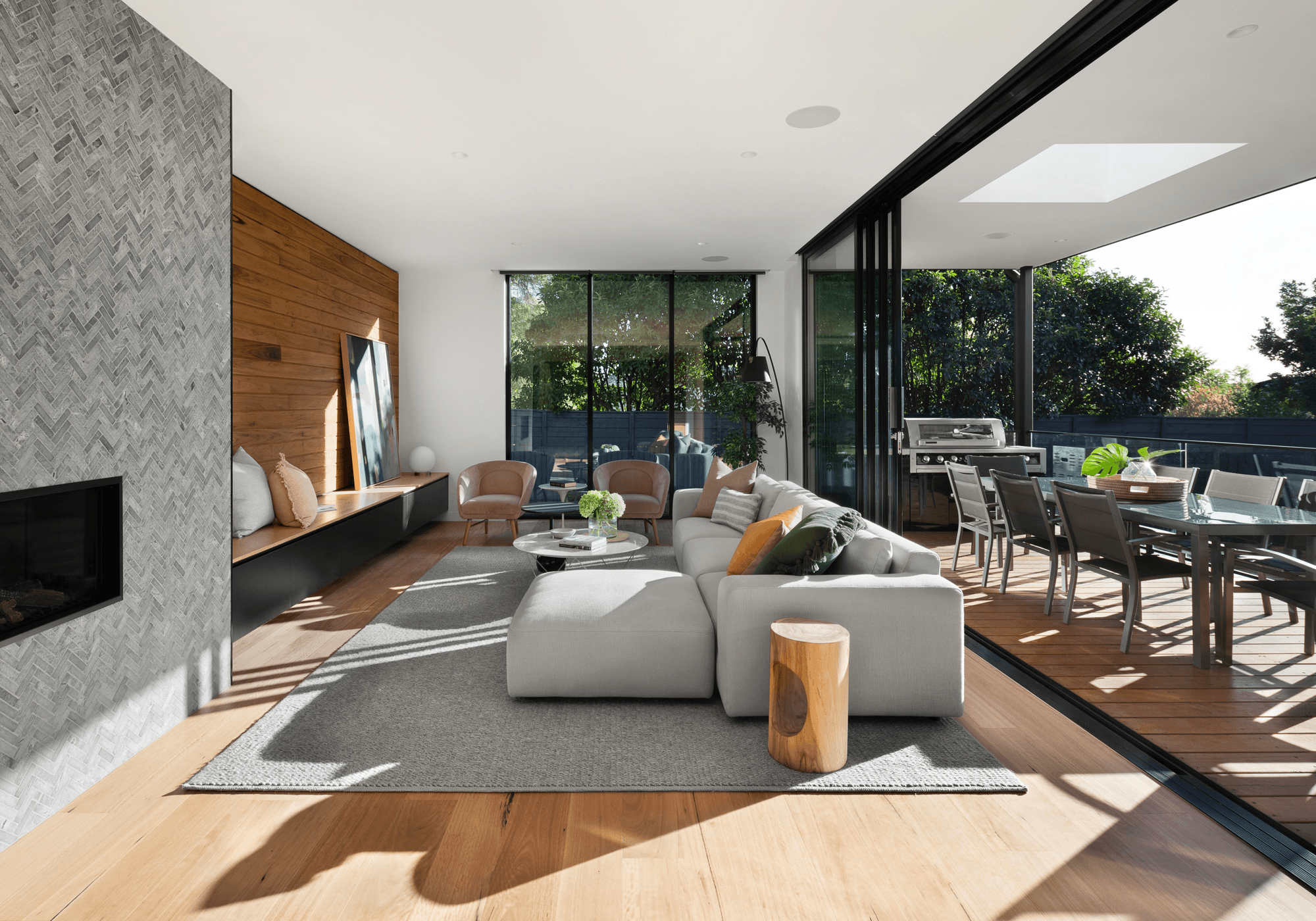

Investments that meet rigorous criteria

Benefit from high growth investment grade properties tailored to the needs and goals of everyday Australians. Our meticulous selection process ensures investment grade properties backed by extensive third-party research and in-depth analysis of property, economic and demographic factors.

A meticulous selection criteria for choosing the right investment property

Capital Growth Potential

Explore areas with robust capital growth, consistently achieving an average annual growth of 6%. Maximise investment returns through sustainable appreciation in asset value, backed by stable population growth, employment opportunities, amenities and accessible infrastructure.

Rental Market and Yield

Our meticulous selection process considers low vacancy rates, indicative of a thriving rental market, enabling investors to maximise potential rental income. We prioritise areas with attractive rental yields, ensuring investors enjoy steady and lucrative returns on their investment properties.

Population Growth

We help you invest in locations with stable population growth and favourable demographics, aligning with the specific type of investment property. This ensures sustained demand for rental properties and long-term profitability.

Infrastructure Spending

We carefully evaluate areas with significant infrastructure investments as it stimulates local economies, supports population growth and enhances access to amenities. This, in turn, drives increased property values over time.

Supply & Demand

Our analysis delves into the intricacies of supply and demand, considering factors like land availability, construction levels and housing preferences of potential buyers. By identifying areas where demand outpaces supply, we uncover opportunities with the potential to outperform the broader market.

Property Type

To ensure value growth, we recommend properties with substantial land components, as land appreciates while buildings depreciate. New homes offer advantages like higher depreciation claims, rent and lower maintenance, while saving on stamp duty and enabling construction of modern dual-income properties.

Tax Benefits

We empower clients with knowledge about the tax advantages of property investment, including depreciation deductions that can significantly enhance overall financial returns. New investment properties offer higher depreciation deductions, translating into greater tax savings compared to older properties.

A meticulous selection criteria for choosing the right investment property

Capital Growth Potential

Explore areas with robust capital growth, consistently achieving an average annual growth of 6%. Maximise investment returns through sustainable appreciation in asset value, backed by stable population growth, employment opportunities, amenities and accessible infrastructure.

Rental Market and Yield

Our meticulous selection process considers low vacancy rates, indicative of a thriving rental market, enabling investors to maximise potential rental income. We prioritise areas with attractive rental yields, ensuring investors enjoy steady and lucrative returns on their investment properties.

Population Growth

We help you invest in locations with stable population growth and favourable demographics, aligning with the specific type of investment property. This ensures sustained demand for rental properties and long-term profitability.

Infrastructure Spending

We carefully evaluate areas with significant infrastructure investments as it stimulates local economies, supports population growth and enhances access to amenities. This, in turn, drives increased property values over time.

Supply & Demand

Our analysis delves into the intricacies of supply and demand, considering factors like land availability, construction levels and housing preferences of potential buyers. By identifying areas where demand outpaces supply, we uncover opportunities with the potential to outperform the broader market.

Property Type

To ensure value growth, we recommend properties with substantial land components, as land appreciates while buildings depreciate. New homes offer advantages like higher depreciation claims, rent and lower maintenance, while saving on stamp duty and enabling construction of modern dual-income properties.

Tax Benefits

We empower clients with knowledge about the tax advantages of property investment, including depreciation deductions that can significantly enhance overall financial returns. New investment properties offer higher depreciation deductions, translating into greater tax savings compared to older properties.

Generate reliable cash flow

Invest in properties that generate regular cash flow, reducing debt and ensuring financial freedom. Discover how property investments can provide a reliable income stream for lasting financial stability.

Minimise tax liability

Minimise your tax burden and maximize savings by leveraging optimised deductions on mortgage interest, maintenance costs, and property taxes. Learn how strategic tax planning can enhance your financial benefits.

Maximised investment returns

Unlock the full potential of your investments with a personalised investment strategy. Benefit from exclusive off-market opportunities and strategic partnerships with brokers and developers to maximize your investment returns.

Build lasting wealth

Achieve lasting wealth and financial security through appreciating assets. With ongoing support and guidance, confidently pursue your goals and establish a solid foundation for long-term prosperity for yourself and your loved ones.

Time to act now: Why investing in property today can lead to financial success

NSW

"I have been a client of Wealth Street for about 10 years. I have found the advice and help in purchasing property, refinancing and investment invaluable and outstanding. I would not have the financial security I have today without this amazing company. I have recommended them to my friends and family who have also been impressed by their outstanding advice and professionalism.”

Review Wealth Street↑ $475,000

Growth since purchase

Harsha and Ashwini

Sydney, NSW

Harsha and Ashwini gained $475,000 growth in 3 years on their first property, and $96,000 growth on the second, transforming property investment into a rewarding journey.

VIEW CASE STUDY

Wealth Street Journal: Week 9, 2025

Wealth Street Journal: Week 7, 2025

Wealth Street Journal: Week 6, 2025

Wealth Street Journal: Week 5, 2025

Wealth Street Journal: Week 4, 2025

Wealth Street Journal: Week 3, 2025

Wealth Street Journal: Week 2, 2025

Wealth Street Journal: Week 52, 2024

Wealth Street Journal: Week 51, 2024

Wealth Street Journal: Week 50, 2024

Wealth Street Journal: Week 49, 2024

3 Top Tax Tips to Help You Navigate Tax Time

Wealth Street Journal: Week 26, 2024

Wealth Street Journal: Week 23, 2024

Wealth Street Journal: Week 22, 2024

Wealth Street Journal: Week 21, 2024

Wealth Street Journal: Week 20, 2024

Wealth Street Journal: Week 19, 2024

Wealth Street Journal: Week 18, 2024

Wealth Street Journal: Week 17, 2024

Diversifying brokers into wholesale property: Finsure introduces Infynity automated referrals to Wealth Street

Wealth Street Journal: Week 16, 2024

Wealth Street Journal: Week 15, 2024

Wealth Street Journal: Week 14, 2024

Wealth Street Journal: Week 13, 2024

Inflation Eases: Property Market Opportunity For Investors?

The Australian Housing Market: 2023 in charts with CoreLogic

Steering brokers towards success: A message from our CEO

Peek into the future: 5 factors set to transform the property market in 2024

Wealth Street and Finsure light up Diwali with a celebration to remember

How to use equity to invest in property

Australian housing market defies challenges: CoreLogic November housing chart update

National Construction Code 2022 (NCC) update: A glimpse into Queensland’s leading role in home accessibility and energy efficiency

Australian real estate surpasses $10 trillion: CoreLogic October housing chart update

From the rugby pitch to property: George Burgess joins Wealth Street

Australian real estate soars to $10 trillion: CoreLogic September housing chart update

An Australian-first: Wealth Street integrates into Finsure’s CRM

RBA interest rates on hold; have interest rates peaked?

Empowering brokers for business excellence: Inside our EOS annual planning session

Why invest in residential property now?

Houses vs units; which is the better investment property in Australia?

Switching fields: Luke Burgess goes from NRL Rabbitohs to Wealth Street’s financial arena

Welcome to the new Wealth Street

A CEO’s perspective: Navigating our core values at Wealth Street

Australian property values continue to climb: CoreLogic August housing chart update

How rising interest rates can benefit property investors in Australia

Australian property prices defying interest rate rises: CoreLogic July housing chart update

The power of time in the property market

Unlocking tax benefits for your property investor clients

Get Started

Every success story starts with a leap of faith. Start a conversation with us.